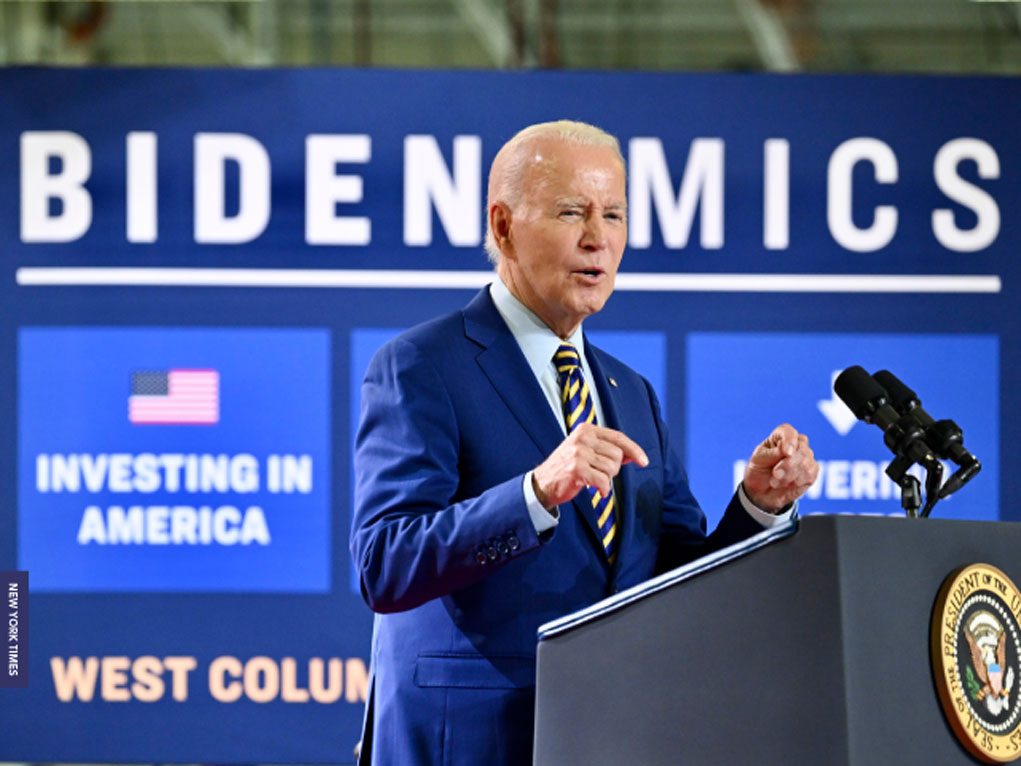

In a bold and somewhat desperate political move, Joe Biden and his presidential campaign have reversed course by publicly embracing the term “Bidenomics,” which has been widely used over the past two years to describe his failed liberal economic policies. He began that process by radically redefining the invented word’s meaning, in a lengthy campaign speech that he delivered to a friendly liberal audience at the old Post Office in downtown Chicago on June 28.

Biden is seeking to portray the $1.9 trillion of excess Covid-relief spending in his “American Rescue Plan,” as well as on the liberal agenda items in the $550 billion bipartisan infrastructure bill, as well as last year’s [misnamed] $370 billion Inflation Reduction Act, and the $280 billion Chips Science Act, as investments necessary to reinvigorate the American economy. He also claimed that all that spending will restore the lost hopes of tens of millions of families now struggling against inflation just to maintain their previous standard of living, and enable them to achieve the classic American Dream, when, in fact, Bidenomics is making the long term-problems due to inflation and rising interest rates even worse.

By trying to rehabilitate the image of Bidenomics, the president hopes to neutralize the single most difficult political challenge facing his 2024 re-election bid, the widespread public perception, even among many Democrats, that his policies are directly responsible for the spike in inflation and the harsh response to it by the Federal Reserve of raising interest rates, which still threatens to throw the economy into a recession.

The rapid rise of inflation coincided with the start of Joe Biden’s presidency in January 2021. Prices for goods and services, which had remained remarkably stable since the end of the Great Recession of 2008 at about 2%, rose sharply, initially, as a result of the severe and widespread Covid-related disruptions in the production and distribution of consumer goods in the United States and around the world.

HOW BIDEN STOKED THE FIRES OF INFLATION

In March 2021, the fires of inflation were further fueled by the passage of Biden’s $1.9 trillion Covid-relief package, despite a public warning from President Bill Clinton’s highly respected Secretary of the Treasury Larry Summers that the additional stimulus was unnecessary and could “set off inflationary pressures of a kind we have not seen in a generation.” He was right. It did.

The Biden administration then added insult to injury by claiming for far too long that the spike in inflation was transitory, and by trying to persuade the Americans that the economy was in far better shape than they thought, despite the daily reminders of the ravages of inflation they saw when they went shopping at their local supermarkets or filled up their gas tanks at the pump.

That was the real reason why most Americans have been so skeptical of the Biden administration claims that the economy is improving. A Gallup Poll taken last month reported that 66% think the economy is getting worse, not better. In an AP/NORC survey in May, 64% disapproved of the way Biden has handled the economy, including 39% of Democrats.

Nevertheless, some strategists believe that it’s smart politics for Biden to claim ownership of the economy, and try to turn it into a campaign asset instead of a liability, especially because it’s an issue that no incumbent presidential candidate running for re-election can avoid.

A president running for reelection almost always gets saddled with the credit or the blame for the current economy, regardless of who is most responsible. For the past two years, that has meant that Americans were blaming Biden for inflation, but without giving him the credit Democrats think he deserves for strong job creation and for lowering the costs of a small number of prescription drugs.

PRESIDENTS ARE ALWAYS HELD RESPONSIBLE FOR THE ECONOMY

“You can bet that Donald Trump [as the likely 2024 GOP candidate] is going to ask voters the same question that Ronald Reagan posed when he ran against Jimmy Carter in 1980: Are you better off now than you were four years ago?” Democratic strategist Doug Sosnik predicted. “Biden has to have an answer to that.”

Other first-term presidents have been defeated because of voters’ concerns about their handling of the economy. George H.W. Bush, for example, lost his reelection bid in 1992 to Bill Clinton in part because many voters perceived him as out of touch with the basic everyday facts about the domestic economy, an image that Clinton’s supporters reinforced during the campaign. Polls showed that many voters were disappointed in President Bush because he had no idea about such things as the price of a loaf of bread or a quart of milk. That was why the political battle cry repeated often by Clinton’s leading campaign advisor, James Carville, was, “It’s the economy, stupid!”

Fortunately for Biden, the economic statistics have recently begun to change in his favor. After two years in which prices were increasing faster than wages, real incomes are slowly rising once again. Economic growth has recovered to about 2% a year, job creation remains strong, and, most important, the rate of inflation has declined to 4% from last year’s peak of 9%. Yet high inflation has remained persistent for certain basic and essential items that have hurt many Americans’ budgets.

As a result, only about a third of Americans (36 percent) approved of how Biden was handling the economy in a June Yahoo-YouGov poll, while a June Quinnipiac poll found that only 24 percent of Americans (less than 1 out of 4) rated the nation’s economy as “excellent” or “good,” and 55% disapproved of Biden’s handling of the economy. Similarly, a CBS News poll found that nearly two-thirds of U.S. adults rated the economy as fairly or very bad, with just 36% approving Biden’s handling of the economy, and 64% disapproving.

Consumer sentiment about current economic conditions, as measured by the University of Michigan, stood at 69 in June, up from 65 in May and 54 in June 2022. But it remains far below 114, which is where the index stood in January 2020, just before the Covid pandemic.

Jason Furman, who was an economic adviser to former President Obama. notes that the bottom quarter of American workers by income has benefitted the most so far from the Biden economy, due to more jobs being available at higher wages.

“In some ways, I think that’s a wonderful thing, but it isn’t as wildly popular with the public as one might like it to be,” Furman said.

BIDEN’S INFLATION/INTEREST RATE DILEMMA

He also notes that the need to keep fighting inflation leaves Biden in a difficult spot. “If you’re taking credit for falling inflation right now then you’re taking credit, in part, for the Fed’s decision to raise interest rates,” Furman said. “Does that mean you own the downside [a possible recession] of the Fed doing that?”

White House officials have been frustrated by voters’ failure to react to the more upbeat recent economic numbers by upgrading the president’s job approval numbers, but some Republican strategists say that they are not surprised. While the current rate of inflation may be easing, prices are still stuck at much higher levels than most consumers are comfortable with.

“The consumer price index is 16% higher than when Biden came to office,” Republican pollster David Winston pointed out.

In addition, financial pundits keep warning that a recession is just around the corner, especially if the Federal Reserve begins to raise interest rates again.

Meanwhile, Biden and his campaign strategists are betting that what matters most isn’t how good Bidenomics looks to voters now, but how good it will look to them a year from now, when they start thinking more seriously about choosing among the candidates for the White House in November, 2024. The president is embracing Bidenomics now in the hope that if the economy does continue to improve, voters will be more willing to give him the credit for it at that time, when it matters most.

As a Wall Street Journal editorial put it, “The White House is undertaking a political salvage operation over the economy. . . embracing what we have long called Bidenomics as a badge of honor. . . because it can read the polls. Mr. Biden’s approval rating on the economy is 38.3% in the latest Real Clear Politics average.

THE LINGUISTIC ORIGINS OF BIDENOMICS

For much of his presidency, Bidenomics has been used by the president’s conservative critics as a pejorative. The Washington Examiner ran a column in May 2021 headlined “Three pitfalls of Bidenomics.” The New York Post decried “The Bane of Bidenomics” in June 2021 and bemoaned “Death by Bidenomics” four months later.

The Wall Street Journal, in an article published last July titled, “Bidenomics 101” concluded: “The president doesn’t appear to know anything about how the private economy works.” As recently as this June 8, the paper ran a story headlined “Bidenomics and Its Contradictions.”

Later that day, during a news conference with British Prime Minister Rishi Sunak, Biden uttered the word “Bidenomics” publicly for the first time, despite admitting to some bafflement about the term’s meaning.

He said it again at a June 17 rally with union members in Philadelphia, where he declared that it was “time to end the [Republican] trickle-down economics theory,” and then added, “we decided to replace this theory with what the press has now called ‘Bidenomics.’ I don’t know what the h— that is, but it’s working.”

But by the time of Biden’s first major speech of his 2024 re-election campaign in Chicago, his redefinition of the term Bidenomics had been fleshed out and expanded to encompass and celebrate all of the liberal spending items in the main pieces of legislation that he has passed since entering the White House, and the 13.4 million new jobs he created by spending hundreds of billions of dollars of taxpayer money to subsidize certain liberal-favored industries and green energy initiatives.

BIDEN COMPARING HIS POLICIES TO REAGAN’S

In his Chicago speech, Biden contrasted the focus of his economic goals on benefitting the middle class, to “Reaganomics” of the 1980s and the economic policies of former President Donald Trump, whose similar aims were shrinking the size of government and cutting taxes, by implying that they were primarily intentioned to benefit the wealthy rather than working and middle-class families.

“If Reaganomics was based on the idea that if you cut taxes for the wealthiest corporations, the wealthiest people in the society, and then at some point the remnants of those will trickle down to the middle class and the working class, Bidenomics is the exact opposite,” Anita Dunn, one of Biden’s advisers, said in an MSNBC interview. “Bidenomics says that the way you grow the economy, in this economy, is you grow the middle class,” she claimed.

However, most Americans who lived through that era recall Reaganomics as a smashing success. By introducing “supply-side economics,” President Reagan defeated the malaise of Jimmy Carter-era of stagflation. He also lowered taxes and eliminated unnecessary government regulations, thereby reigniting American prosperity.

BIDEN STILL SEARCHING FOR A COHERENT ECONOMIC POLICY

Gary Burtless, a senior fellow in economic studies at the liberal Brookings Institution, credited Biden with passing major initiatives through a divided Congress, but he struggled to define what is specifically “Biden” about Bidenomics. “There’s not a distinctive economic policy,” Burtless said. “I can’t think of what Bidenomics would be, really.”

He added: “He has sympathy for the blue-collar worker and would like to get industries back in the United States where we’re not so vulnerable to international interruptions in trade. But that’s more of an evolution than a distinctive new policy.”

- Glenn Hubbard, who served as chairman of the Council of Economic Advisers during George W. Bush’s administration, agreed that Bidenomics represents a less coherent philosophy than prior presidential economic programs such as Reaganomics.

With those philosophies, “I can tell you what they meant in terms of principles,” Hubbard said. “Bidenomics, to the extent that it’s a thing, is much like Trumponomics — it’s kind of a grab bag of protectionist and industrial policies.”

Daniel T. Rodgers, a Princeton University historian, said it’s not unusual for a president’s critics to tie his name to an unpopular policy or phenomenon — like Herbert Hoover getting tagged with “Hoovervilles,” the shantytowns that sprouted during the Great Depression.

Rodgers suggested that using a term like Bidenomics suggests that Biden’s approach has more coherence than it actually does. “In some ways, what Biden’s spokespeople seem to be doing is trying to clean up the impression they have nothing but a confused set of policies and that he’s been [assembling] piece by piece.”

The use of nicknames derived from a president’s name to describe their economic policy choices has been a common practice. The terms “Reaganomics” and “Clintonomics” were often used to describe the more consistent economic approaches of Presidents Ronald Reagan and Bill Clinton.

By contrast, Bidenomics is essentially an uncoordinated collection of expensive industrial policy initiatives that Biden managed to get through Congress during his first two years in office, despite strong Republican opposition. Their main common political strategy boils down to simple job creation.

As New York Times “On Language” columnist William Safire explained in a 1992 essay, “For the “omics” suffix to work, the president’s name must end in an n. This all began when some of us in 1969 began pushing ‘Nixonomics.’”

THE LINGUISTIC DESCENDANT OF OBAMACARE

The current effort to redefine the implications of the phrase Bidenomics is reminiscent of the Democrat effort to improve the image of Obamacare, a word first used by Republicans to express their contempt for President Barack Obama’s Affordable Care Act, the health-care reform bill passed and signed into law in 2010. Republicans saw Obamacare as the first step toward socialized medicine, and an overbearing government intrusion on the relationship between doctors and their patients.

But despite a rough start, within two years of its initial passage, “Obamacare” had gained so much public support that Supreme Court Chief Justice John Roberts sought to avoid declaring it unconstitutional by adopting a highly questionable legal approach, apparently because he feared that striking it down would have generated too much public resentment.

President Obama joked about the pejorative use of the term by Republicans in 2011, saying “I have no problem with people saying ‘Obama cares.’ I do care. If the other side wants to be the folks who don’t care, that’s fine with me.”

Celinda Lake, a pollster for Biden’s 2020 campaign, said voters tend to make their decisions based on the direction of the economy in May or June of the election year, which would give the Biden campaign just 10 or 11 months to boost the president’s numbers in time to help him win re-election. But she said Biden would also need to contrast his economic policies with what Republicans might do on issues of taxes and spending to re-frame the 2024 as a policy choice rather than a referendum on the job performance of a relatively unpopular first-term president.

CAN BIDEN BEAT TRUMP BY RUNNING ON BIDENOMICS?

Many Americans say they believe that Donald Trump was a more effective steward of the economy than Biden is, despite the fact that the economy collapsed under Trump during the opening phase of the pandemic. If Trump does turn out to be the Republican 2024 nominee, the fact that more Americans regard him as stronger on the economy could become Biden’s biggest re-election problem.

Lake said that, just as “Obamacare” was initially a pejorative that turned into a positive label for the Affordable Care Act when Obama ran for re-election in 2012, Bidenomics can become the same for this president — if he and his team remain focused on telling people about their economic accomplishments.

According to Labor Department statistics, the U.S. economy added 209,000 jobs in June, the smallest pickup in jobs since December 2020, signaling a slowing but still strong labor market.

President Biden cheered the June jobs report as more evidence that “Bidenomics” is working.

ALL ABOUT THE JOBS

“Our economy added more than 200,000 jobs last month — a total of 13.2 million jobs since I took office,” Biden said in a statement. “That’s more jobs added in two and a half years than any president has ever created in a four-year term.”

The government employment sector, which added 60,000 jobs in June, had been slow to recover since the end of the pandemic. Health care added 41,000 jobs, driven by increases in hospitals, nursing facilities, and home health services. Construction also saw strong gains, adding 23,000 jobs, despite rising interest rates that have made buying homes more expensive.

There is also evidence that rising wages have prompted many prime working-age adults who had dropped out since the pandemic to return to the labor market. In June, the share of workers between 25 and 54 years old who were working or looking for a job, reached its highest rate in more than two decades. That increase was greatest among prime-age women who have rejoined the labor market at record-breaking levels for the past two months.

In May, there were roughly 1.6 job openings for every worker looking for a job, a ratio that has tempted many workers to switch jobs in the expectation of finding better opportunities. Also, if consumers feel so secure in their jobs, they will keep spending, making it harder for the Federal Reserve to bring inflation down.

The Biden campaign is still dealing with a very mixed economic picture. Since last year, experts have warned that the U.S. economy could be headed for a recession. But despite some cooling in the housing and manufacturing sectors, the strong labor market has helped prop up the broader economy, even as the Fed has aggressively raised interest rates to slow it down.

Average hourly earnings accelerated last month, rising by 4.4 percent over the year, to $33.58 per hour. But Federal Reserve policymakers worry that such fast-rising wages hamper their ability to bring down inflation, which was 4 percent last month — double their 2% target rate. The continued stronger-than-expected growth in jobs and wages is expected to prompt the Federal Reserve to resume interest rate hikes later this month, after holding them steady in June, to see whether the overheated economy had cooled enough yet.

WHY SOME ECONOMISTS ARE STILL WORRIED

While the current economy keeps producing lots of new jobs month after month, it is also an economy with persistent inflationary pressures and fears of a recession that have kept people worried.

According to the June jobs report, the number of people who worked part-time because their hours were cut, or for other economic reasons beyond their control, rose by 452,000, the biggest jump in more than three years. The black unemployment rate, which had reached a record low in April at 4.7 percent, rose in May and again in June, to 6 percent, which is an ominous sign because of research showing that black workers are the first to lose their jobs in economic downturns.

Other sectors of the economy where job growth stalled in June include retail, transportation and warehousing, manufacturing, and the information sector, which includes tech.

Job gains for the month in accommodations and food services fell to less than 5,000, leaving employment in the leisure and hospitality sectors still about 2 percent below pre-pandemic levels.

THE REPUBLICAN RESPONSE TO BIDENOMICS

In contrast to the positive White House reaction to the June jobs report, GOP House Ways and Means Committee Chairman Jason Smith said: “President Biden’s so-called ‘Bidenomics’ shows how out of touch he is with working Americans. Small businesses and workers are being harmed by weak economic growth and the Fed hiking interest rates to combat inflation created by Democrats’ reckless spending. Even job growth is darkened by the fact that wages have not kept up with a 15.5 percent increase in prices since Joe Biden took the Oath of Office. For 26 straight months, wages have not kept up with inflation, shrinking the value of every paycheck bit by bit. Meanwhile, rising interest rates have made the American Dream of buying a house or expanding a small business a fantasy for many.”

Other Republican critics of Bidenomis point out that in the June jobs report, the April and May new jobs numbers were revised down by a total of 110,000. They also note that the inflation surge since Biden became president has already cost the average American family $10,000; 1 in 6 retirees now say they are considering returning to work; and 55 percent of retirees who went back to work did so because they needed more money. They also say that the outlook for the near future is also not good, pointing to the current prediction by the New York Federal Reserve of a 71 percent probability that the economy will slide into a recession by May 2024.

Rick Newman, a senior columnist for Yahoo Finance, writes that “Biden is basically in a game of chicken with the business cycle. One tolerable scenario for him would have been to get a mild recession over and done with in 2023, so a recovery would be well underway as the 2024 elections hit the home stretch. But that scenario now appears to be unlikely to happen. So Biden’s best hope is that the economy will not suffer any downturn at all for the next 15 months, getting him past 2024 Election Day. But the likelihood of that is up to the Federal Reserve and its interest rate policies, which is something that Biden can’t really control.

The Fed has already raised interest rates by 5 percentage points since last March, and the Fed’s chairman, Jerome Powell, has been talking about the need to impose one or two more interest rate hikes this year to get inflation back down to the Fed’s 2% target range, even if that does trigger a recession next year, which would be the worst case scenario for Biden’s re-election hopes.

BIDEN TALKING ABOUT EVERYTHING BUT INFLATION

White House officials described Biden’s June 28 Chicago speech as a “cornerstone” event for the president, following another campaign event at which he highlighted more than $42 billion being provided to states to spend on high-speed internet projects funded by his bipartisan infrastructure law. Biden likened the impact of expanded internet service to the electrification of rural sections of the nation in the 1930s by President Franklin D. Roosevelt.

In South Carolina last week, he repeated his claims for Bidenomics by touting the rebuilding of bridges financed by the bipartisan infrastructure bill and bragging that workers in new semiconductor factories, financed by the Chips and Science bill, will make as much as $100,000 a year — “and you don’t need a [4-year college] degree!”

But in each of those speeches, talking about all of the borrowed government money he was spending, Biden didn’t have much to say about how he was going to keep bringing down inflation, except for promising that it’s still “one of my top priorities.” It was a politically significant omission that didn’t sit well with some centrist Democrats.

“I would have liked more of a narrative about Joe Biden, Inflation Fighter,” said Will Marshall, president of the relatively moderate, despite its name, Progressive Policy Institute.

Republicans, on the other hand, point to high inflation that has overwhelmed wage gains for many Americans, gasoline prices that have fallen since last year but still remain about $1 higher than when Biden took office, and further increases in government spending that will drive up inflation.

“What he has been putting forth hasn’t been successful and people perceive that his policies haven’t worked,” said Republican pollster David Winston.

THE RETURN OF “STAGFLATION”

Since Biden took office in January of 2021, Republicans have sought to identify his failed policies with the economic malaise which characterized Jimmy Carter’s disappointing one-term presidency, which was also characterized by the combination of high inflation and stagnate economic growth, then known as “stagflation.” While Biden, in the fight against inflation, has personally claimed credit for the fact that gasoline prices have fallen since last year, and that wages have been rising, most American middle and working-class families are painfully aware that gas prices are still about $1 per gallon higher than when Biden took office, and that the cost of essentials such as food, shelter, and utilities has been rising even faster than their wages.

Republicans emphasize that inflation is a regressive tax that hurts families more the less money they have. Most working- and middle-class American voters are well aware that they are effectively poorer today than they were during the Trump administration. The White House Bidenomics campaign is an effort to convince them to ignore the clear evidence of their eyes and their wallets that they are still failing to keep pace with the rising cost of living, and Biden’s dismal approval rating on his handling of the economy reflects that reality.

WHY VOTERS ARE UNHAPPY WITH BIDEN’S ECONOMIC POLICIES

Despite the bright spots in the latest jobs report, to this point, President Biden has failed to deliver a broad-based improvement in living standards for most American workers who did not lose their jobs during the Covid downturn. For them, the post-Covid period has been characterized by falling real wages, as prices have grown faster than their paychecks. Those who have suffered the most since Biden took office are the members of America’s large population of retirees living on fixed incomes who are especially sensitive to rising consumer prices. For most of these voters, who have suffered a decline in their real income, Bidenomics has yet to deliver any significant economic improvement.

Trump’s presidential campaign has also welcomed the comparison to Biden’s economic record. It said in a statement that “Bidenomics” is the opposite of Trump’s economy, which it said was marked by “low taxes, low regulations, low inflation,” and maximized “American energy production for affordable energy, fair trade, and no job-killing globalists agreements.”

BIDEN’S FALSE VIDEO CLAIMS

Meanwhile, in an effort to defend Biden’s economic record, his re-election campaign recently posted a video claiming, “Here Are the Facts.” It begins with the statement, “Under the Biden Harris Administration Inflation Has Fallen,” which is blatantly false, because the annual inflation rate that Biden inherited when he took office from Trump was just 1.4 percent, less than half of the 4 percent it is today.

The Biden video goes on to claim that the current 4% rate of “inflation is less than half what it was last summer,” when it peaked at 9.1 percent in June of 2022. While technically accurate, that claim is misleading for two reasons.

First, inflation is cumulative. Much like compound interest, it just keeps adding up. For example, even though the annual rate of inflation in May was just 4% over the past year, that came on top of last May’s 8.3 percent annual rate of increase for a two-year total increase of more than 12 percent, and an average of 6% a year. In fact, since Biden took office in January 2021, inflation has increased by a total of about 16 percent.

Second, the inflation rate has now slowed primarily because the Federal Reserve dramatically increased interest rates, rather than any of Biden economic policies. In fact, most economists now agree that Bidenomics was one of the primary causes for the inflation surge, especially Biden’s $1.9 trillion American Rescue Plan.

ADDING UP ALL THE COSTS OF BIDENOMICS

In adding up the costs of Bidenomics, we must also include the consequences of the Federal Reserve’s increase in interest rates over the past 15 months from near zero to about 5 percent which was required to bring inflation under control. The interest rate shock led to three of the four largest bank failures in our nation’s history, threatening the banking sector’s integrity, and requiring a massive federal intervention and bail-out, at the ultimate expense of taxpayers. It has also made buying a home or a car, paying down credit cards, or getting a small-business loan far more expensive for individual Americans due to the sharp increase in interest rates.

The Biden video also falsely claims that “Wages are up, accounting for inflation,” giving American workers “real breathing room.”

In fact, citing official Labor Department statistics, a Wall Street Journal editorial notes that, “In 1982-84 dollars, which takes account of inflation, average hourly earnings were $11.39 when Mr. Biden took office but started to decline immediately and didn’t stop falling until inflation peaked in June 2022. They have bounced up a little but were still back only to $11.03 in May [2023]. That’s a 3.16% decline in real earnings for the average worker across the 29 months of the Biden Presidency.”

As a result, the Wall Street Journal editorial ends by facetiously asking “to see how [Biden’s] economists cherry-picked the data to justify that one.”

While the recent slide in the rate of inflation from 9% to about 4%, getting it all the way down from there to the Federal Reserve’s 2% will prove to be difficult if the economy keeps generating new jobs at the current rate, putting more pressure on Chairman Powell and the Fed to keep raising interest rates, which could trigger the long predicted recession that is likely to undermine all of the benefits that the president is now claiming on behalf of Bidenomics to date.

BIDEN HAS TWO CONFLICTING ECONOMIC RECORDS

According to Greg Ip, the chief economics commentator for the Wall Street Journal, “Biden really has two economic records. One of them begins in late 2021 and consists of a series of legislative wins on infrastructure, semiconductor production, and renewable energy, which he then preserved in a debt-ceiling deal with Republicans. These policies could shape the economy for years to come.

“That record, though,” Ip writes, “is overshadowed by the record of his first months in office, when his American Rescue Plan pumped $1.9 trillion of demand into a supply-constrained economy. The result was the tightest job market in memory and a surge in inflation that still hangs over Biden’s approval ratings and his prospects for re-election.

“In his speech in Chicago. . . Biden didn’t differentiate between these two records: It’s all ‘Bidenomics,’ which, he said, is about expanding the middle class, bolstering infrastructure, and bringing manufacturing back from overseas. This doesn’t really distinguish Biden from other presidents, though. Don’t they all want a stronger middle class, more infrastructure, and more factories?

“His early agenda was also not particularly novel. The Rescue Plan was an old-fashioned Keynesian demand stimulus, notable mostly for its sheer size,” and inspired by the policies that were adopted by the Obama administration in response to the 2008 global financial meltdown.

BIDEN RESPONDED TO A FICTITIOUS ECONOMIC CRISIS

In a memo released last week, by Biden’s political strategists, Anita Dunn and Mike Donilon, they claim that the president “faced an immediate economic crisis when he took office” in January 2021, which Ip insists was not true.

“By then, the economic crisis brought on by Covid-19 was largely over, even if the health crisis wasn’t. As lockdowns were lifted and vaccines approved, businesses were furiously rehiring,” Ip wrote. “The American Rescue Plan, in other words, was designed to bolster demand in an economy that already had plenty,” he concludes, which may explain why the rate of job creation continues to remain so strong, resulting in “the tightest labor market in memory that particularly benefitted historically disadvantaged groups: black, Hispanic and low-wage workers.

“But many of the benefits of that tight labor market have been negated by inflation [which] is the main reason voters disapprove of Biden’s handling of the economy by a two-to-one ratio.”

Ip also notes that “it’s logically inconsistent for Biden to disown inflation while taking credit for tight labor markets since they are mirror images of the same thing: an overheated economy.”

While Ip credits Biden for getting three bills passed by Congress financing “the largest federal commitment to industrial policy in recent history,” he notes that “this newly assertive role for the federal government in shaping private investment isn’t without controversy. It is bulking up deficits, its ‘buy American’ provisions have upset allies, and it has lowered the bar to interventions of questionable merit.

“Nor is it likely to change Biden’s political prospects: The effects on voters’ lives are small and gradual, whereas the effects of inflation and unemployment are big and immediate.”

Ips also notes “that despite GOP success in forcing a step toward fiscal sanity with the recent debt-ceiling deal, a new report from the Congressional Budget Office shows that Mr. Biden has largely succeeded in keeping the United States on the path to fiscal ruin.”

THE LONG-TERM GOALS OF BIDENOMICS

In another Wall Street Journal opinion column, Andy Kessler writes that Bidenomics has much larger goals than the president has so far revealed. “[It] throws free trade and free-market capitalism under the bus in favor of centralized government controls reminiscent of the old Soviet Union’s five-year development plans.

In January, U.S. Trade Representative Katherine Tai, speaking to the elite economic crowd attending the annual meeting in Davos, called for a “new economic world order” that was “worker-centered,” which means, in plain English, government-enforced wage floors and price controls.

In April, Biden’s national security adviser, Jake Sullivan speaking at the Brookings Institution revealed the existence of a “new Washington consensus” that government should control more parts of the economy, including a “global labor strategy that advances workers’ rights” and “targeted and necessary investments in places that private markets are ill-suited to address on their own.”

According to Sullivan, the government is now “making long-term investments in sectors vital to our national well-being” by trying to pick winners and losers from electric vehicles and batteries to biomass. . . This is a “modern American industrial and innovation strategy.”

THE END OF THE AMERICAN FREE MARKET SYSTEM

In other words, free market competition in America is now rapidly being replaced by a Bidenomics industrial policy designed by the so-called “experts” of the Biden administration, whom Kessler says he “wouldn’t trust to run a lemonade stand.”

Kessler cites a front-page article that recently appeared in the Sunday New York Times that “all but declared free markets dead because ‘globalization hastened climate change and deepened inequalities.’”

Kessler also notes the striking similarities between the Bidenomics industrial policy and “the Trump administration’s worst mistakes, like tariff or the USMCA free-trade agreement that’s not free at all because it’s actually a progressive labor and environmental power play…

“[It’s] the same as Donald Trump’s anti-big-tech, nationalist, nativist populism just without the [Mexican border] wall.” Also, Kessler concludes, “There is no mention of Bidenflation and falling real wages.”

In other words, when Joe Biden talks about needing a second term to “finish the job” that he started over the past two years, he is talking about putting an end to the capitalist, free market-based-American economy and replacing it with a socialist-inspired centralized system that will enable government “experts” to dictate every aspect of our economic and private lives.