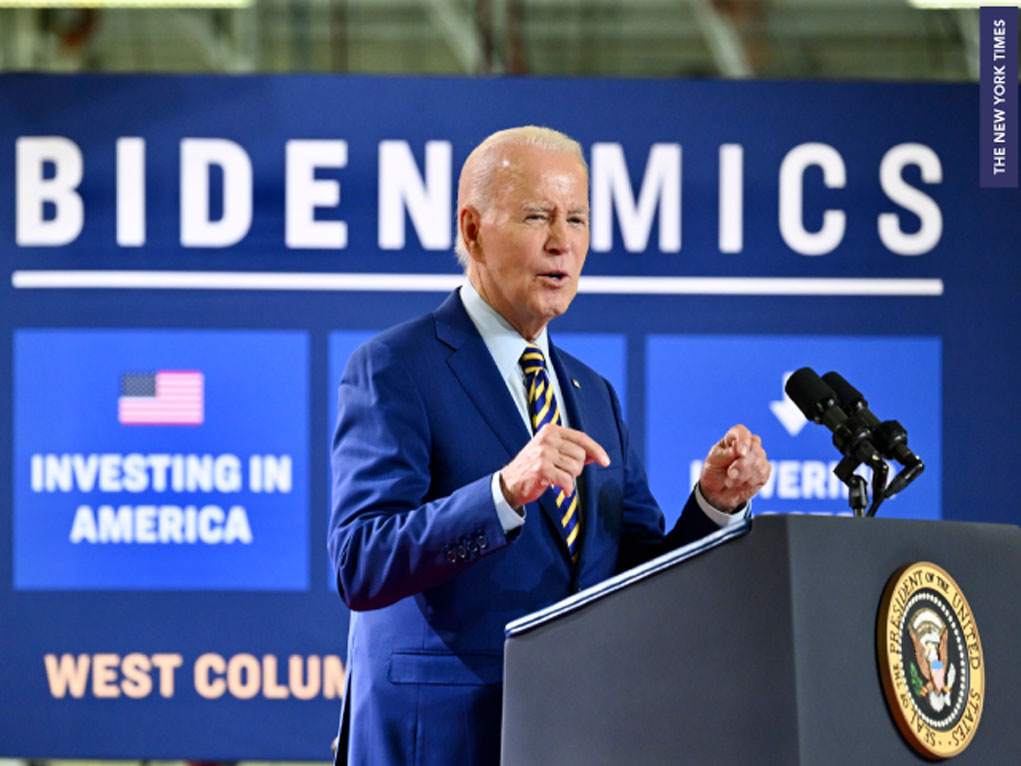

Last week’s first GOP presidential candidate’s debate in Milwaukee, Wisconsin, began with a discussion of the failures of President Biden’s economic policies, based upon a video clip of the president declaring “They call my plan ‘Bidenomics.’ I’m not totally sure they meant it in a totally complimentary way at the time. But guess what? It’s working!”

One of the debate’s moderators, Fox News reporter Brett Baier, immediately challenged the president’s claim citing the fact that “more than 65 percent of Americans say the country is headed in the wrong direction,” and listing complaints from unnamed people on the street in Wisconsin about the devastating impact of those higher prices. One person said, “Gas is high and food is high. A lot of people out here are homeless because they can’t buy food,” and another said, “It’s tough when you’ve got mortgage rates at 7-8 percent versus 2 to 3. It’s just, you can’t afford a house anymore.”

The first question in the debate was about the growing alienation and frustration of the American people with the federal government in Washington, as reflected in the bitter lyrics of a wildly popular current protest song entitled “Rich Men North of Richmond.”

In response, Florida Governor Ron DeSantis, who is still in second place in the GOP polls behind former president Donald Trump, said, “Our country is in decline. This decline is not inevitable. It’s a choice. We need to send Joe Biden back to his basement and reverse American decline. And it starts with understanding we must reverse Bidenomics so that middle-class families have a chance to succeed again. We cannot succeed as a country if you are working hard and can’t afford groceries, a car, or a new home.”

The GOP candidates then discussed the out-of-control government spending, which they agreed is at the heart of the inflation problem, combined with President Biden’s ongoing war on the domestic fossil fuel industry which is driving up the cost of energy. Those factors have made it necessary for the Federal Reserve to raise interest rates so high, in an effort to bring down the rate of inflation, that the American dream of owning their own home has become unaffordable and is out of reach for so many young working class families today.

But the Biden administration stubbornly refuses to accept the harsh reality that Bidenomics is a disaster for working-class families. Instead, it chooses to cherry-pick those government statistics, such as a low national unemployment rate and strong GDP growth, which support its claim that Bidenomics is working, while ignoring the polls showing that most Americans strongly disagree.

Former restaurant chain CEO and conservative commentator Andy Puzder, writing for the British newspaper, the Daily Mail, says that trying to make sense of the Biden administration’s economic policies reminds him of the famous opening line from Charles Dickens’s classic novel, The Tale of Two Cities.

“‘It was the best of times; it was the worst of times.”

“Listening to the Biden White House on economic issues is always a surreal experience [because] they can’t keep [their story] straight,” Puzder complains.

“While President Biden claims ‘Bidenomics is working,’ his Vice President Kamala Harris bemoans the fact that ‘[m]ost Americans are a $400 unexpected expense away from bankruptcy.’

“So, which is it?” Puzder asks.

Puzder chooses the latter, “it was the worst of times,” citing the fact that the rate of inflation for consumer prices in July, 3.2 percent, compared to 3 percent for June, has reversed course and increased for the first time in 12 months.

Also in July, consumer credit card debt topped $1 trillion for the first time in U.S. history.

Bank of America has reported that in the second quarter of 2023, 36 percent more people drained their retirement accounts to meet their normal living expenses, compared to the same period last year.

According to the Wall Street Journal, new and used car prices and auto loan interest rates have become so high that many consumers are finding that they can no longer afford to make their car payments, which now average more than $750 a month, at an interest rate of 9.5%. General Motors reported that its new car prices rose by 3% in the second quarter of this year alone, reaching an average of $52,000, while the average selling price for a used car is now $27,000, which is 30% higher than before the Covid-19 pandemic. As a result, the rate of defaults on consumer auto loans has now risen to the same level as during the height of the 2008 financial crisis.

BIDEN’S ECONOMIC CHUTZPAH

According to conservative commentator Victor Davis Hanson, “The reason why more than 60 percent of the nation has no confidence in Bidenomics is because it destroyed their household budgets …

“[President] Biden is on track to increase the national debt more than any one-term president …

“Bidenomics is a synonym for printing up to $6 billion dollars at precisely the time post-Covid consumer demand was soaring, while previously dormant supply chains were months behind rebooting production and transportation.”

Biden has “raised the price of energy, gasoline, and key food staples 20-30 percent since his inauguration without a commensurate rise in wages, and then [triggered] the worst inflation in 40 years.”

Hanson notes that “Gas is nearly twice what it was in January 2021. Interest rates have about tripled. Key staple foods are often twice as costly — meat, vegetables, and fruits especially.”

Yet Biden still has had the chutzpah to claim that his Bidenomics policies “beat inflation.”

Even though the rate of price increases has now fallen to around 3%, the net result of the inflation spike has been the devaluation of the U.S. dollar by 16% since Biden took office. And because of the dollar’s reduced purchasing power, the typical American family was forced to spend $709 more on its monthly expenses this July than it did in July two years ago.

According to an estimate from The Heritage Foundation’s Center for Data Analysis, the average American family has lost $6,800 in spending power due to inflation and higher interest rates.

THE MISNAMED INFLATION REDUCTION ACT

In recent weeks, the Biden administration has been celebrating the anniversary of the passage of the so-called Inflation Reduction Act (IRA) last August, two months after inflation peaked at 9.1 percent. But despite its name, the IRA legislation actually had almost no impact on the root causes of the inflation. It consisted of additional green energy subsidies, including renewed tax rebates for the purchasers of U.S.-made electric vehicles, healthcare subsidies, a new minimum tax on large U.S. businesses, and money to hire tens of thousands of new IRS agents, who will be used to harass upper and middle-income American taxpayers.

When the IRA was first proposed last summer, the nonpartisan Congressional Budget Office (CBO) scored the cost of the legislation and warned that its net impact on inflation would be “negligible.” Nevertheless, the Biden administration sought to credit the IRA legislation for the decline in the rate of inflation, even though they knew it wasn’t true.

President Biden admitted as much at a recent campaign fundraising event, when he said, “The Inflation Reduction Act — I wish I hadn’t called it that, because it has less to do with reducing inflation than it does to do with dealing with providing for alternatives that generate economic growth.”

WHY IS INFLATION RECEDING?

What is the real reason why the rate of inflation had been declining? Economists cite four different factors.

First and foremost, over the past year and a half, the Federal Reserve has rapidly raised interest rates from near zero to more than 5%. By doing so, the Fed has been following the classic formula for fighting inflation by making money more expensive to borrow, thereby deliberately slowing down the economy by reducing the demand for goods and services, which, in turn, has relieved some of the pressure to increase prices.

By driving up interest rates, the Fed deliberately made borrowing prohibitively expensive for many businesses, forcing them to defer their expansion plans. The average sales price of an American home is more than $120,000 higher today than it was at the start of the pandemic, and with 30-year fixed mortgage interest rates now exceeding 7%, the highest they have been since 2002, millions of American families who had been seeking to purchase their first home have now found that they are no longer able to afford the sharply increased monthly mortgage payments.

In a related move, the Fed has also drastically slowed its purchases of Treasury-issued debt securities, which it had followed as a strategy to stimulate the economy known as “quantitative easing.” Instead, the Fed has been a net seller of Treasury securities since inflation peaked last summer, soaking up some of the excess money in the economy that had been boosting the prices of nearly everything.

Second, to artificially lower the price of gasoline at the pump, President Biden has drained almost half of the crude oil that was stored in the national strategic petroleum reserve (SPR), which was only supposed to be used in times of war or another national emergency. Since energy affects everything we do and everything we buy, it did help to reduce gasoline costs.

The continued draining of the SPR is not a practical long-term strategy, both because its capacity is limited, and because a large amount of stored oil is still needed to serve as a backstop in case of a major disruption of oil shipments from the Persian Gulf, which are vital to the global economy.

BIDEN STILL WAGING WAR ON FOSSIL FUELS

Meanwhile, in the name of fighting climate change, the Biden administration has continued to wage war on the domestic fossil fuel industry by the imposition of new taxes and regulations, and by further restricting the industry’s efforts to produce more American oil, coal, and natural gas. That will further limit their supply, and eventually result in a sharp increase in the cost of all forms of energy to U.S. consumers and businesses, boosting the rate of inflation once again.

A third factor slowing the rate of inflation has been a slight reduction in the rate of growth of federal government spending, due to the expiration of Covid-related federal stimulus and welfare payments, and the Republican takeover of the House of Representatives as a result of the 2022 midterm election.

Lastly, a global economic slowdown has temporarily reduced international demand for American exports, prompting some producers to cancel planned price increases. But none of those factors address the main long-term problem driving inflation, which is excess government deficit spending, putting too much new money into circulation relative to the size of the American economy.

Meanwhile, even though the rate of inflation has come off the highs it hit last year, at about 3 percent it is still one-third higher that the Federal Reserve’s 2 percent target rate. Furthermore, because the Biden administration is still determined to spend 40% more money than it collects in taxes, the current rate of inflation shows no signs of going lower, anytime soon.

MORE “FREE” GOVERNMENT MONEY

The new government spending mandated by the IRA forced the U.S. Treasury to effectively borrow additional dollars from the Federal Reserve, and that money was then added to an already overheated U.S. economy.

The IRA’s climate change subsidies and tax credits, originally estimated to cost taxpayers less than $400 billion over the next decade, will be much more expensive than anticipated. According to a more recent Goldman Sachs estimate, the real cost will be more than $1.2 trillion, three times the original figure, completely wiping out the $238 billion reduction in the budget deficit that the Biden administration had originally claimed for the legislation.

According to Treasury Secretary Janet Yellen, the availability of the IRA’s federal green energy subsidies and tax rebates for the purchasers of American-made electric vehicles, as well as heat pumps and other energy-efficient home appliances, has prompted many companies to invest $500 billion to build nearly 200 new lithium battery factories and other clean energy projects mostly across the Midwest and the South.

The additional spending in the IRA comes on top of the $550 billion in new money contained in the 2021 bipartisan infrastructure bill, to be spent on expanding access to broadband internet service, upgrading the electrical power grid, and electric vehicle subsidies, in addition to long overdue repairs of existing infrastructure. Biden was only able to pass the infrastructure bill with the support of 19 Republican senators, but their crucial role is rarely mentioned by Biden and his campaign.

Another piece of legislation the Biden administration passed last summer with significant GOP help was the so-called Chips and Science Act. It authorizes the spending of $280 billion over the next decade on new factories for the domestic production of the latest generations of semiconductor computer chips, which are vital both to national defense and various sectors of the American economy.

FEDERAL SUBSIDIES ARE NO GUARANTEE OF SUCCESS

A Wall Street Journal editorial notes that while “government can always get more of what it subsidizes,” those subsidies are no guarantee of long-term benefits from that taxpayer investment in “politically favored industries.”

It also notes that “most of these green-energy investments wouldn’t be happening if not for subsidies.” All that government money has generated a corporate “gold rush” to cash in on the generous tax credits available.

According to the editorial, “Panasonic expects to pocket $2 billion in tax credits each year for its battery factories in Nevada and Kansas. First Solar will rake in $710 million from the government this year for its solar panels — nearly 90% of its forecast operating profit.

“Oil and gas companies are plowing more money into subsidized green technologies because they can yield a higher return on investment than hydrocarbons,” which helps to explain why there hasn’t been more growth in domestic oil and natural gas production since the end of the Covid lockdowns.

Energy companies seeking capital from banks to finance new drilling are being asked for more collateral and higher risk premiums. But “the IRA authorized the Energy Department (DOE) to lend up to $400 billion for climate projects. . . [and] green-energy businesses can borrow from the government at the [much cheaper] Treasury rate,” the editorial notes.

Nevertheless, the editorial cites disturbing signs that at least one major new government green-energy investment is already in trouble. “After receiving a $9.2 billion DOE loan for two battery factories, Ford announced last month it is throttling back its electric-vehicle production targets amid mounting losses.” In June it announced 3,000 layoffs to fund its EV transition. “The transition to EVs is happening. It just may take a little longer,” [Ford] CFO John Lawler assured investors.

WHAT HAPPENS IF CONSUMERS REFUSE TO BUY ELECTRIC CARS?

“What happens if Americans don’t buy EVs?” the Wall Street Journal editorial asks. “They may not have a choice,” it answers, “as Democratic states and the [Biden] Administration plan to punish automakers if they sell too many gas-powered cars — penalties that will be paid by customers and workers.”

As a result, the editorial warns, “The EV transition will subtract from [U.S. economic] growth in coming years if auto sales and profits decline.”

The editorial also notes that “the IRA is the heart of Bidenomics, which is about creating a new political-subsidy economy.” But instead of boosting the economy, there is a real risk that the “hundreds of billions in misallocated investment will reduce future productivity gains and translate into slower economic and income growth.”

The editorial concedes that because of the “surge in [government] investment, at least in the short term, GDP will see a boost, much as it did from the welfare payments during the pandemic.

“But the test of all this spending isn’t the number of new projects that break ground. It’s whether those projects will be more productive than those that would otherwise have gone ahead if the government hadn’t [re-directed] the capital.”

As a cautionary example, the editorial cites the disappointing results of President Obama’s $831 billion American Recovery and Reinvestment Act of 2009. The economic stimulus that it had promised from so-called “shovel-ready” projects was never delivered.

THE VICTIMS OF BIDENOMICS

The primary victims of Bidenomics and the high prices it has created are working-class Americans like 41-year-old Doordash driver and homeschool mom Ruby Nicole Day, who lives in South Lebanon, Ohio. She is one of the millions of Americans who have been struggling to make ends meet in the era of Bidenomics, and, according to her op-ed published on the Newsweek website, she has now reached the point of despair.

“One of the strangest things about being a working-class American is hearing politicians talk about the American Dream, when everyone I know knows the truth: The American Dream is dead, at least it is for us.

“Of course, everyone defines the American Dream in their own way … For me, the American Dream would be to have my own home so I don’t have to worry about being evicted by my landlord, enough money to pay for electricity, water, and internet for my homeschooled child, a car so I can get to work, and a bit of savings, in case the car breaks down.

“So far, this has eluded me, though not for lack of trying. I work three jobs and pick up any extra work when asked. But I still make just under what my bills come out to each month. I’ve thought a lot about why that is, and the conclusion I’ve come to is that it’s because I don’t have access to real opportunity…

“If you grew up lower income in the 1980s like I did, you didn’t get to go to college and get a degree. Forty years later, that means you’re stuck working a job that doesn’t have the benefits that diploma-requiring jobs do. Meanwhile, the cost of living went up — but wages stayed the same. Many like me are stuck in a dead-end job with low wages and no way out. The American Dream has become an American nightmare…

“It’s just not true that all Americans are given the opportunity to pursue the American Dream. Good jobs often require a college degree, even if they don’t require any skills you would learn at college. But we in the working class get locked out of those opportunities over a formality, a piece of paper.

Day then issues a heartfelt plea to corporate employers. “Give us a chance and let us prove that we can help your company accomplish. Give the person who’s been with your company for five years a chance to prove they can be a manager, or a supervisor, instead of passing them over for someone who has no understanding of the culture of your company but got a piece of paper from an institution. . .

“At the end of the day, we don’t want handouts. We want opportunities to work hard and thrive, instead of working hard and sinking.”

THE AMERICAN PEOPLE KNOW THE TRUTH

Lanhee Chen, a Hoover Institution fellow, admitted during an NBC News panel discussion of the reasons behind President Biden’s low job approval numbers, that he was “confused” about the political strategy behind Biden’s campaign efforts to persuade voters that they have benefitted from “Bidenomics.”

“You’re trying to convince people of something, you’re trying to convince people their own impressions about the economy are wrong,” Chen said. “And so, if you look, for example, at how Hispanic and black voters feel about the economy, they’ll tell you it stinks.”

“Now they [Biden supporters] can keep saying, ‘But we have the CHIPS Act, but we have the IRA.’ [However,] at the end of the day, you can’t convince someone that they’re feeling, how they’re feeling about the economy is wrong,” Chen continued. “And that’s what this election is going to come down to. And I get they’re trying to present a proactive message but at the end of the day, it’s very difficult I think to do that when people simply feel differently.”

American voters are not the only ones who hold a dim view of Bidenomics. The Fitch credit rating agency recently downgraded its rating on securities issued by the U.S. Treasury from a top-tier AAA score to a less stellar AA+ because it expects the U.S. to suffer “fiscal deterioration over the next three years.” More specifically, Fitch economists are predicting, “tighter credit conditions, weakening business investment, and a slowdown in consumption” that will push the U.S. economy into a “recession” at the end of this year or the beginning of 2024.

To be fair, the recent sharp decline in the rate of inflation, at the same time that the U.S. economy continues to generate new jobs at a faster rate than expected, is encouraging news. But many lower- and middle-class American consumers are still struggling to pay the higher prices for the essentials of living that were generated by the spike in inflation over the past two years, and while their wages have also been rising, it has not been fast enough to keep pace with their cost of living.

That is why only 37 percent of Americans most recently polled by CNN say they approve of Biden’s handling of the U.S. economy, and according to a survey by Reuters/Ipsos, two-thirds of those who said they voted for Biden in the 2020 election believe that the U.S. economy today is “worse” or “about the same” as it was back then, when Donald Trump was still president.

INFLATION WAS TRIGGERED BY BIDEN’S COVID RELIEF BILL

Many consumers are well aware that the spike in inflation was probably triggered in March 2021, when Biden and the Democrats passed a $1.9 trillion spending bill called the American Rescue Plan. Biden claimed that the bill was needed for emergency Covid relief, but in fact, it was probably unnecessary because of previous relief bills that Congress had already passed, and because the American economy was already in recovery from the impact of the pandemic lockdowns. Congressional Republicans and even President Bill Clinton’s former Treasury Secretary, Larry Summers, warned the Democrats and Biden that the bill would probably trigger a spike in inflation, but that good economic advice was ignored.

In addition to paying the costs for Covid vaccine distribution, testing, and treatment, the Biden relief bill vastly expanded unemployment benefits, and provided $350 billion for state and local aid. It was also laden with all kinds of liberal spending programs which had nothing to do with the pandemic, such as a major increase in the federal child tax credit.

All that unnecessary extra “relief” money that the bill pumped into the economy quickly led to an explosion in the rate of inflation. While prices for all kinds of goods and services, such essentials as gasoline, food, rent, and household utilities, are no longer rising at the former 9.1 percent rate, very few of them have come back down to anywhere near the level they were before inflation spiked.

IGNORING INFLATION UNTIL IT WAS TOO LATE

Many American voters also vividly remember how slow the Biden administration was to even recognize that inflation was a problem. Biden administration officials and Federal Reserve Chairman Jerome Powell repeatedly said that the spike in inflation was “transitory,” an unfortunate side effect of the disruptions created by the Covid lockdown which would quickly subside without doing serious damage. But as the months went by and the inflation steadily worsened, the American people learned once again that the “experts” could be wrong and that the Biden administration’s assurances could not be trusted.

Now that the worst of the inflation is over, Biden and his supporters are trying to convince the American people that “Bidenomics” was the solution rather than the cause of the inflation problem. But the American people know better. They are reminded, every time that they fill up their car with gas, buy food at the supermarket, or sit down to pay their monthly rent and utility bills.

As Mitch McConnell, the Republican minority leader in the Senate, recently said: “No matter how many ways administration officials spin the numbers, folks who work for a living and manage a family budget know that ‘Bidenomics’ has made their lives harder.”

The extent of that inflation has been closely tracked by the Consumer Price Index (C.P.I.) published monthly by the federal government’s Bureau of Labor Statistics (BLS). Based upon the total cost of a basket of commonly purchased goods and services, the BLS reports that the cost of living for the typical American household has risen by 16.9 percent in the two and a half years since Biden took office. What is worse, the cost of household essentials, such as food, rent, and utilities, has been rising at a much faster rate, almost 25%, since Biden took office. That imposes a disproportionately greater burden on lower-income families, because those essentials consume a much greater portion of their income. While Biden administration advocates have argued that average wages have also been rising by about 12% during that same period, they have not kept pace with rising prices. As a result, the typical American household is now forced to spend $709 a month more than it did two years ago.

Furthermore, the economic pain from these price increases is not limited to the poor. One survey found that 53% of people who earn between $50,000 to $100,000 a year admit that they are living from paycheck to paycheck. A separate survey by the Lending Club puts that number at 61 percent, and as high as 69 percent in certain cities. Yet another survey says that 57% of Americans say that they could not afford to cover an emergency expense of $1,000 or more. All of these people are now living on the edge of financial ruin.

TOO MANY AMERICANS STRUGGLING TO MAKE ENDS MEET

In a July CBS News survey, nearly three times as many people said they are falling behind economically as those who said they were getting ahead.

Another government measure of the economic health of American households, compiled by the U.S. Census Bureau, is called the Household Pulse Survey (HPS). One of the regular questions it asks is whether the respondent is “having difficulty paying for usual household expenses.”

When the survey was taken at the end of the Trump administration, in January 2021, 80.53 million Americans said that they were finding it “somewhat” or “very” difficult to pay their household expenses. Today, that number has increased by more than 6 million, meaning that under Bidenomics, more than 1 in 3 households are struggling to pay their bills. Furthermore, among households earning $50,000 to $75,000, the number struggling to pay their bills increased by about one-third from 10.01 million in January 2021, to 13.4 million in July 2023.

Thanks to Bidenomics, many millions of Americans are now drawing down their savings, maxing out their credit cards, and raiding their retirement accounts just to meet their monthly living expenses. They are the victims of Bidenomics, and what’s more, most of them know it.

That is why Biden’s decision back in June to campaign for re-election on the strength of the success of Bidenomics has been such a dismal failure so far. Yes. Strong new job creation is a good thing, especially for those people who are looking for one. But everyone must pay the higher prices when the government enables inflation to spiral out of control.

PRICES THAT HAVE GONE UP MAY NOT COME DOWN

Furthermore, when inflation finally subsides, that doesn’t mean that every price will revert to its previous lower level. On the contrary, except for certain market-traded commodities, most prices will tend to stay at their new, higher levels.

The American people know that the misleading statistics suggesting that Bidenomics is working are merely the reflection of the trillions upon trillions of budget deficit dollars that the Biden administration has recklessly squandered on its liberal policy agenda, without any regard for the long-term consequences, of which ruinous inflation is only the first.

Even though wage growth has just recently begun to exceed the rate of inflation, too much purchasing power has already been lost by tens of millions of lower and middle-class American households due to Bidenomics for Democrats to reasonably expect those voters to reward them for it at the polls next Election Day.